When people choose to invest in precious metals, very few of them even consider palladium. In fact, there are even people who have never heard of this metal and unfamiliar with its value. In fact, palladium, like platinum, is fairly new in the world of precious metals. Gold and silver were around in ancient civilizations and palladium only came along in the 19th century. However, even though it is new, palladium is a valuable and viable option for those interested in the precious metals market.

Palladium investing in 2013 is expected to be very strong as well. Because people are still not interested in putting their money in the stock market, the slowly strengthening economy just isn’t enough for most savvy investors to take chances once again. They want to know that their money is safe in something stable and secure. Because the investment potential is not the only demand for palladium, there is intrinsic value in this precious metal that will hold strong in the future.

The Intrinsic Value of Palladium Investing in 2013

Lately, palladium has been catching on as an attractive jewelry option. This metal, which is finer than silver and not as expensive as platinum is also strong and durable so that it won’t lose its beauty anytime soon. That’s not the only intrinsic value for palladium either. This precious metal is used for certain processes in the automotive industry. It can be used as a viable alternative to platinum in catalytic converters, which are essential parts to control emissions on a vehicle.

Unlike gold, which depends heavily on demand from the investment market, palladium has enough value in other areas that it will hold strong even if the economy gains ground and many investors turn away. This type of stability is enough to make the precious metal an excellent option for anyone to add to their portfolio.

Uncertain Reserves

Palladium can be mined in several different places including Russia, South Africa, Canada, and the United States. However, the supplies mined in North America are fairly low.

Instead, the vast majority of it is found in Russia, and this brings about some speculation and uncertainty. No one knows for sure how much of the metal is left to be found. Additionally, no one knows if unrest in Russia or South Africa could disrupt the mining process.

This brings an extra level of value to the precious metal. There very well could be not that much palladium available to be found. That pushes the value up and makes palladium investing in 2013 an even more appealing option.

Your Investment Choices for Palladium Investing in 2013

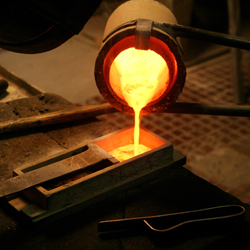

If you do wish to invest in palladium, keep in mind that you will be buying the physical metal, not just a certificate saying that you own something. Palladium bullion bars are designed specifically to give you a choice. Different bars carry different weights and purities so that you can invest the amount of money you would like. This allows you to either diversify or build your whole portfolio out of the precious metal.

If you are looking for an alternative option to investing in the stock market, then you should consider palladium investing in 2013. This option is fairly unknown when compared to the rest of the precious metals world, but that doesn’t mean it isn’t valuable.

There are very good reasons why you should add palladium to your portfolio since it has an intrinsic value beyond the strength or weakness of the economy. Demand continues to be high because of its need in the industrial world. You don’t have to worry about a strong economy taking away from the value of this precious metal in your portfolio.